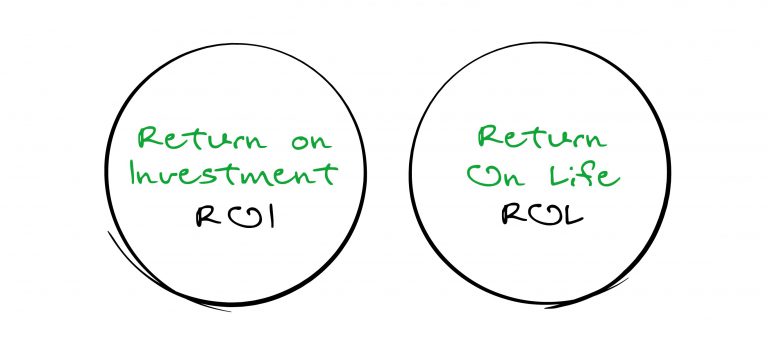

Return on Life (ROL) versus Return on Investment (ROI)

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

July 22, 2022 | 2 Minute Read

I got some interesting responses to last week’s Nano “The Coca-Cola Company and Lawyers”, so let’s connect this week’s Nano to the previous one.

Look at the above Sketch and Ponder over it.

What do you do for your Clients (Pick One)?

- Deliver a 15% return or whatever return

- Find the best product

- Time the Market

- Help them live the life they have imagined with their money.

Assuming you have answered the above, let’s now imagine that you have Aladdin’s magic lamp in your hands.

Rub the magic lamp and the Genie appears. Unlike the story, you are only granted 1 wish. The catch is that you have to make a choice between 2 wishes.

Option a. 15% return

or

Option b. Never have to worry about money and that you will have money when you need it

Which one would you choose for your children and family?

I can bet my life that all of us would Option b (only if you want to kill me would you choose Option a).

Yet when it comes to money, why is it that we think about a 10% or 15% or Highest return, when the purpose of money is to do Option b. A real financial professional or team will help clients exactly do that – help clients get clear about their values (purpose) and then find out what it takes to get them to never ever worry about money, and finally start making progress on that front.

Return on Life is all about helping people live the life they have imagined with their money.

The exceptional professionals of the future will invest their time and money in learning how to effectively deliver ROL to their clients. Not to mention, they are patient and understand the life cycle of a new project (read the Nano – The Valley of Death)

Are you?

P.S. I have given an entire blueprint on how to build the wealth management firm of the future in the book “The HappyRich Advisor.” If you haven’t got your copy yet, click here and order.

Similar Post

Nano Learning

The way to handle an important prospect conversation

“I need time to think” is a centuries old excuse people use, when they cannot decide. Have you come across a prospect who tells you “I need time to think”? Do you think the ....

Read More

30 October, 2020 | 2 Minute Read

Nano Learning

The Next Secret

Last week, I wrote about The Secret. If you haven’t read it, you can check it now (2 minutes read).

Now that you know The Secret, let me share another one with you.

Brad Stul ....

Read More

25 February, 2022 | 2 Minute Read

Nano Learning

Leveraging Collaboration

There is a brilliant Tolstoy quote that we would all do well understand (at a visceral level) -The most difficult subjects can be explained to the most slow-witted man if he has no ....

Read More

24 May, 2024 | 2 Minute Read

Nano Learning

Cellular Wisdom: The Path to Organic Growth

I read a very interesting quote by Steven Hall – “Every single cell in the human body replaces itself over a period of seven years. That means there’s not even the smallest p ....

Read More

1 March, 2024 | 2 Minute Read

Nano Learning

Nobody and Anybody

“Nobody can go back and start a new beginning, but anyone can start today and make a new ending” – Maria Robinson. We always have a choice.

12 May, 2023 | 1 Minute Read

Nano Learning

The Heaviest Things in Life

What’s weighing you down?

It’s not iron. It’s not gold.

It’s the unmade decisions in your life.

As a financial professional, you know how important decisions are for your c ....

Read More

3 January, 2025 | 2 Minute Read

- 0

- 0

0 Comments