The Attention Game

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

November 7, 2025 | 2 Minute Read

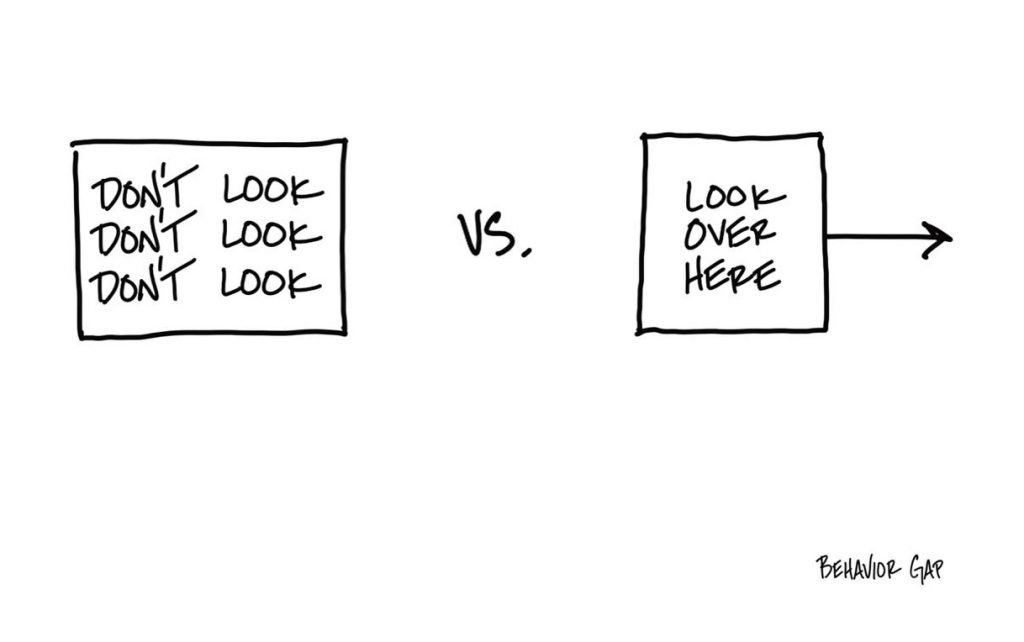

Most financial professionals tell their clients, “Don’t look at your portfolio too often.”

But have you noticed how that rarely works?

The more you tell someone not to look, the more they want to.

It’s human nature.

Tell a child not to touch the chocolate jar, and you know what happens next.

The same applies to investors.

When markets fall, the natural instinct is to look more often, not less.

The problem isn’t curiosity. It’s attention without direction.

Instead of saying, “Don’t look,” a better strategy is to say, “Look here instead.”

Shift their focus from noise to meaning.

From stock prices to goals.

From the portfolio’s value to the plan’s purpose.

When the Sensex falls, rather than asking, “How much did my portfolio drop?”, help them ask, “Has my life plan changed?”

When markets rise, instead of celebrating short-term gains, help them see, “Am I closer to my long-term goals?”

As MFDs and advisors, we are not just money managers.

We are attention managers.

Because what clients look at determines how they behave.

And how they behave determines their outcomes.

Stop telling them what not to do.

Show them what to do.

Don’t say, “Don’t panic.”

Say, “Let’s review what really matters.”

Don’t say, “Don’t look at the markets.”

Say, “Let’s look at your financial strategy.”

Investing success is not about perfect timing.

It’s about consistent focus.

And your role is to help clients direct that focus toward what they can control: their goals, savings, discipline, and time horizon.

Because in investing, as in life, attention is your greatest asset.

It’s not about don’t look.

It’s about look in the right direction.

Similar Post

Nano Learning

This is the difference between Transaction and Client Experience.

17 April, 2020 | 1 Minute Read

Nano Learning

The Weakest Link Continued

Thanks so much for all your lovely responses.

There were different responses such as

-Process or Method of reaching prospects effectively

-Negativity in media about distributor ....

Read More

25 June, 2021 | 3 Minute Read

Nano Learning

Love Made Visible

There is a super powerful poet Kahlil Gibran’s quote – Work is Love Made Visible.

Read, Reflect and Meditate on this one...It’s simply brilliant...

These five powerful words ....

Read More

22 September, 2023 | 2 Minute Read

Nano Learning

The Two Basic Functions of Business

In his 1973 book “The Practice of Management”, Peter Drucker wrote these golden words: “The purpose of a business is to create and keep a customer.

1 September, 2023 | 2 Minute Read

Nano Learning

Get This Right

Most people confuse continuity planning with succession planning and vice-versa. Broadly, they both seem the same because succession planning does provide continuity planning. But ....

Read More

21 October, 2022 | 2 Minute Read

Nano Learning

From Desk to Beach: Mastering the Art of Being Present

Isn’t this a brilliant visual?

While you can interpret this in several ways, there is an amazing insight hidden for all of us.

Hint: Be Happy for this moment. This moment is ....

Read More

14 June, 2024 | 3 Minute Read

- 0

- 0

0 Comments