This Life Side of Money Conversation helped an IFA 4X his assets in 1.5 hours

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

August 18, 2020 | 7 Minute Read

I love financial life planning as a profession for the power it has, to transform lives. Recently, a 59-year-old IFA from Nashik, Ganesh Dharker, experienced the power of this Life side of Money conversation in real time. He is so energized that he now wants each and every client of his to experience the Life Side of Money.

First things First, What is the Life Side of Money (you may ask)?

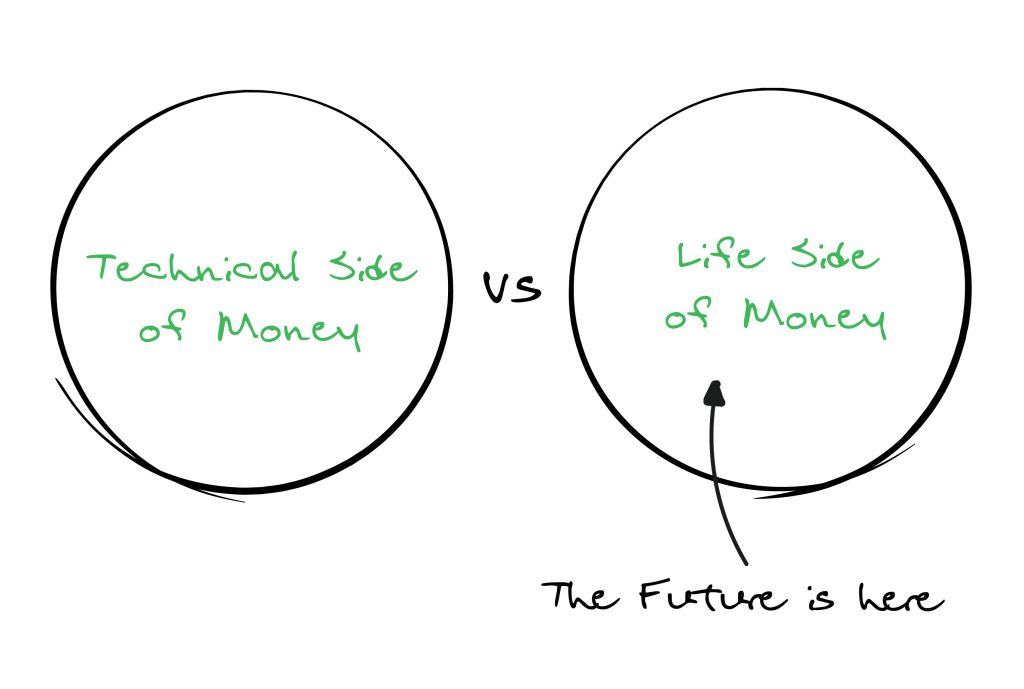

I had written this Nano about the Technical Side of Money and Life Side of Money that will give you a perspective on the concept.

Nevertheless, in short, the technical side of money obsesses over products, returns, benchmarks, markets, and economy. The Life Side of money on the other hand focuses on the Client’s Life and the things that the client would like to do while he/she is alive. Remember your client is not a Number. She is certainly not an Account with Assets. She is a living breathing person with dreams, aspirations, goals, and a purpose.

IFA Dharker and his client in question Ms. Aishwarya Rao virtually met with my colleague Mahesh. Ms. Rao was a client of this IFA for several years and had done a SIP of Rs.45000 with him. She was a very busy professional but always managed to find time to attend to her personal finance matters. Her conversations with Ganesh revolved around how the markets were doing, products, and her portfolio report.

She went through this experience (visual + verbal) with Mahesh while Ganesh was observing attentively. For the first time in many years, Ganesh learnt about so many things that were important to Ms. Rao. At the end of the meeting, Ms. Rao increased her SIP to Rs.1.75 Lakh to achieve all the financial life goals that she had set. Now this is just one part.

The real part was when she said “Thank you so much for doing this for me. I cannot tell you the kind of clarity that I got in the last 90 minutes. I now have a clear picture of what I need, want and where I stand. Furthermore, I can also do this thing that’s very close to my heart.” Every family and individual have some key questions that are going through their mind. The questions are the following

- How much is Enough?

- Do I have Enough?

- Am I doing Ok?

- Will my family be Ok?

- Am I on Track?

- What do I need to do to be on Track?

There are other questions as well, but these are some of the key ones.

Ganesh was shell shocked and was amazed himself from the outcome of this virtual experience. Mahesh then told him “Did you see that I did not speak about products, markets or the economy? I only spoke about her Life and what is important to her. Not only this, look at the energy and the confidence that we managed to ignite in Ms. Rao. She was delighted.”

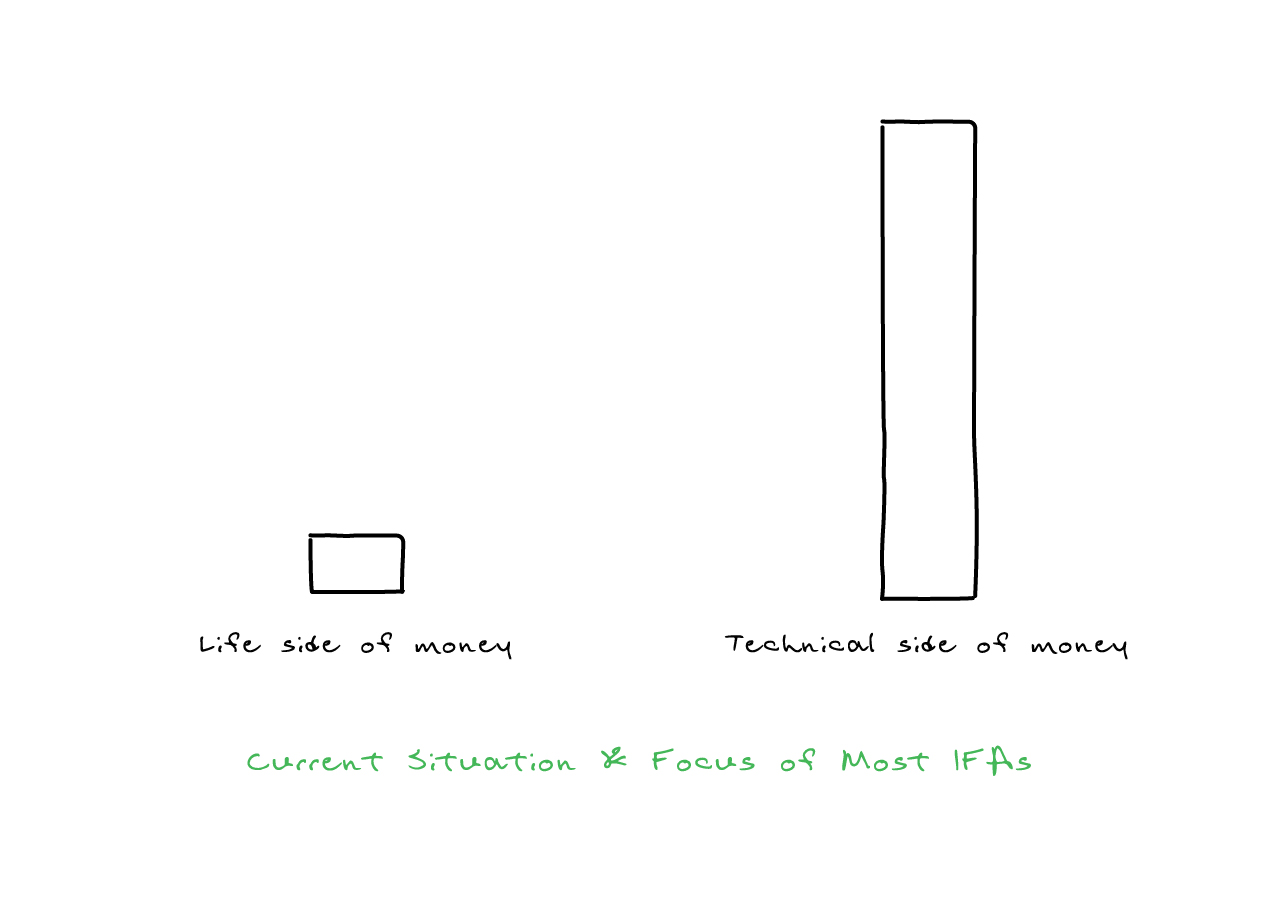

Sadly, Most IFA’s today focus all their Time and Energy like the Sketch given below. They have made the Technical side of money as their value proposition and this is where they focus.

This Technical Side of Money obsession is making your business and life miserable in the following ways.

- Constantly having to prove your value to the client

- Compared with Benchmarks and Markets over which you have no control

- Compared with Competition (there are many firms masquerading as experts and selling garbage). Sadly, the clients cannot differentiate between them and you just like many of you cannot differentiate between the power of financial planning and products

- You are more likely to lose accounts to competition

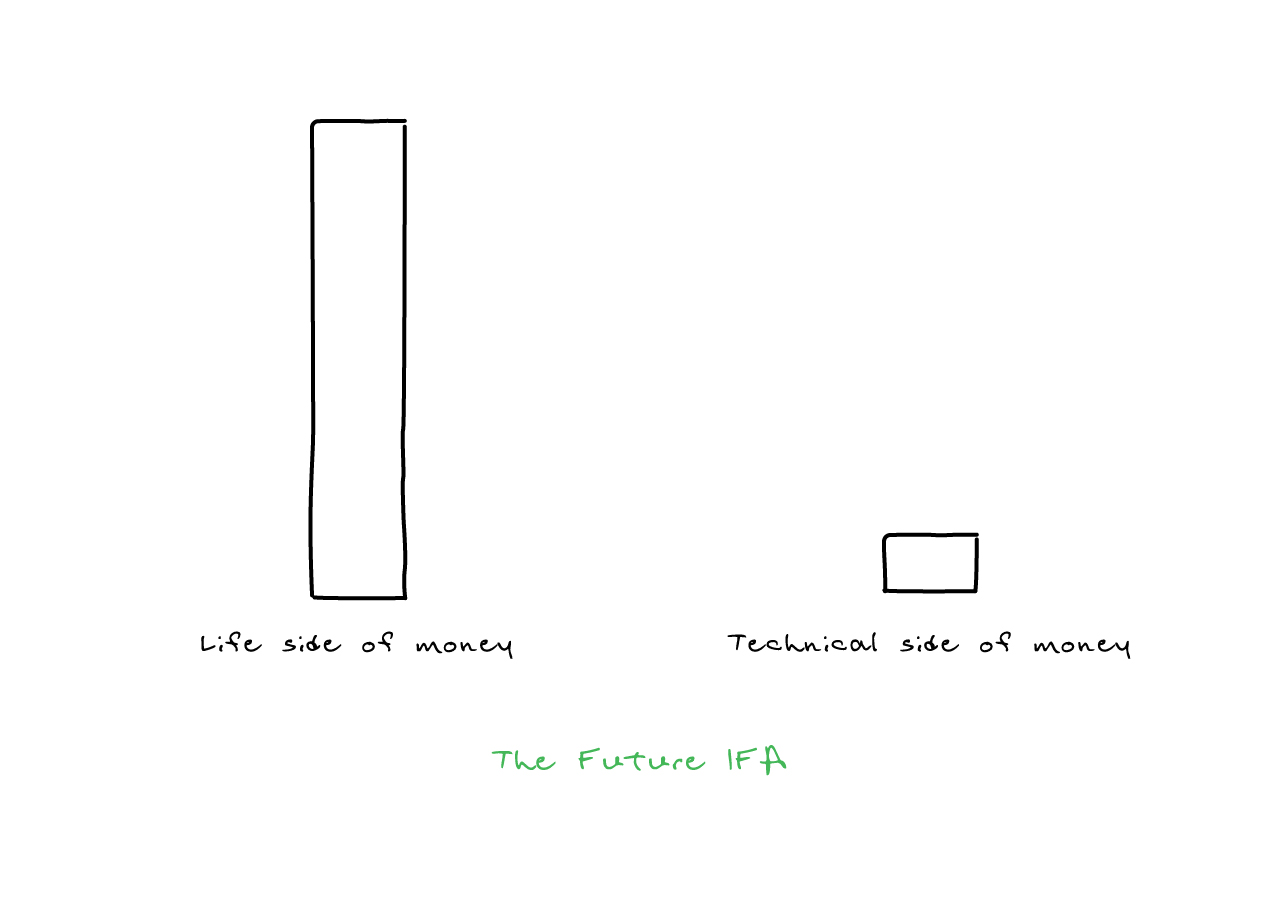

This is exactly what the future of your work is.

Life Side of Money is not a Rumour, or some feel good stuff. This is the Real Stuff, and nothing ever can bring out the true value and power of your work like the Life side of money can.

The only way to believe this (and then start focusing on this) is to experience this yourself. The real problem with most IFAs is that they themselves have never experienced financial planning with a world class professional. How many IFAs have themselves created a financial plan for themselves? Thus, you cannot at a visceral level understand what I am saying unless you experience it.

Finally, read the story of the six blind men and an Elephant. Just like the six blind men, you have heard or even seen mediocre financial planning work at best. It is therefore difficult for you to understand the power of world class work. Do it for yourself and Experience the Power of Life Side of Money.

Similar Post

Growth

The Accountability Mechanism

While I am working on my 6th book (this time the subject is Crypto), I am also writing a book with several other US Financial Advisors on the work that Real Financial Professionals ....Read More

21 September, 2021 | 5 Minute Read

Growth

The Growth Formula of an IFA Firm

I often get asked, “What is your Growth Formula or Is there a Growth Formula that I should be following ?” We all love formulas and silver bullets and so I have attempted to ....Read More

3 January, 2020 | 7 Minute Read

Growth

Beyond the AUM Boom: Preparing for the Tides of Change

I ended last week’s post ‘2024- The Year of Strategic Rethinking’ with the question, “What are you going to change your mind about in 2024?” I am sure you would have thou ....Read More

9 January, 2024 | 5 Minute Read

Growth

Are you solving your Real Problem?

One of the critical areas that all IFA firms have been hit is Revenue. Most firms have seen a drop of 30-50% in revenue. I will not get into the reasons as you know why this has ha ....Read More

26 May, 2020 | 5 Minute Read

Growth

Emma - Part 2

On March 1st, 2022, I wrote a post with the headline “Emma”. Many of you loved it as much as I enjoyed writing it. However, I did not have Part 2 in mind. Call it Serendipity ....Read More

15 March, 2022 | 5 Minute Read

Growth

The Growth Formula of an IFA Firm

I often get asked, “What is your Growth Formula or Is there a Growth Formula that I should be following ?” We all love formulas and silver bullets and so I have attempted to ....Read More

3 January, 2020 | 7 Minute Read

- 1

- 0

0 Comments