The Great Indian MFD “Scale and Succession” Saga

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

August 16, 2022 | 5 Minute Read

I ended last Tuesday’s post “First-Rate Intelligence” with the following questions.

- What new information have you been presented lately?

- Are you afraid to change your mind even in the presence of new (credible) information or will you be bold enough to incorporate this new information and change your mind?

Let me first give you two answers to the first question. There are more but these two are good starting points.

- iFast shutting down in India

- Bharat Phatak joining hands with Scripbox

I wrote my brief take on the iFast story on August 2nd. Click on this link in case you missed it before.

I watched Vijay Venkatraman’s interview “What prompted Bharat Phatak to join hands with Scripbox?”

I must admit that we would have loved to do this deal with Wealth Managers, but let’s put it this way. We were late. Sometimes you miss the boat. But I am so happy that this deal happened even though it was with someone else.

I don’t know Mr. Bharat Phatak and Mr. Ajit Khasnis personally but hats off to them for making this hard decision. Many keep thinking and thinking but never make a decision. This transaction is likely to make many MFDs and RIA’s rethink their long-term scale and succession strategy. More importantly this might inspire others to plan for their successions proactively and quickly.

Let’s quickly go through some of the finer points made in this interview and my take on them.

The first point that Bharat made was “If one needs to scale, one can’t do it without the digital way of doing things. And digital simply doesn’t mean doing something on the internet. It means things have to be designed differently right from the start to solve a problem.”

I wrote a post called “The Grand Inversion”, two months back. You should read it even if you have read it before.

In that post, I had shared the following –

The entire financial services industry has been built on a physical first experience right from the way you open accounts, interact with bankers, relationship managers, financial professionals to even closing the accounts including everything in between. Remember the good old days of filling up forms whether in banks or in our industry. By the way, paperwork still exists for many in the financial services space. Don’t believe me. Go take a loan and the number of documents you have to sign is not funny. How about closing a loan? The experience is even more frustrating.

On the other hand, digital has emerged in the last 15 odd years as a secondary channel. It’s a place where you can check your accounts, make some payments, order check books and so on. In short, you can conduct simple self-service activities (transactional in nature) on the digital side. The digital was considered to be a supplemental part of the core experience.

However, this has begun to change now (and will more so in the future) and this is exactly what the grand inversion is – the digital experience will become the core experience and will be supplemented by some sort of physical or in-person experience. Thus, you need to not look at digital not as a channel but as a way of serving your customers.

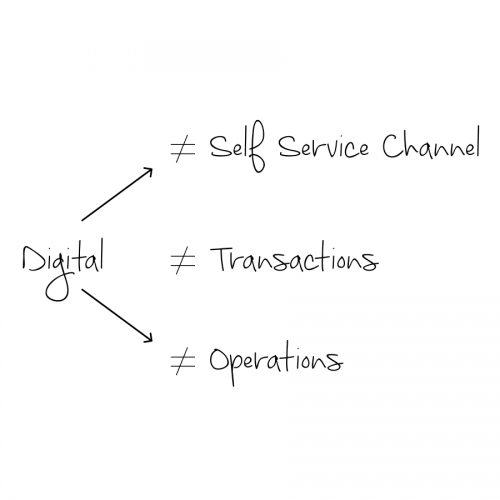

One of the most important things in addressing this grand inversion is to change our mindset in terms of not thinking of digital as a self-service channel or transactions or operations.

The second and one of the most important points Bharat made was “Technology is not our strength. Getting a vendor or trying to employ people who will build a solution for us will all be suboptimal. It will not take us where we need to be, and we will always be behind the curve.”

Coming to this conclusion itself is half battle won. Many in our industry/profession simply don’t get this. The intention is to be blunt here (I won’t try to sound politically correct even at the risk of raising a few eyebrows). Many just don’t get this important insight.

At the same time, there are many vendors who are ready to oblige you with a product and entice you to build your own tech stack. However just like Personal Finance is more about Personal than it is about Finance, Personal Finance Tech too is more about Personal than it is about FinTech.

The key thing that needs to be addressed is this – How do we make the care and guidance of a real financial professional just as rich remotely? How do you form strong connections remotely and in a global environment?

All of the above can then be supplemented with a physical experience. Thus, it will also be important to figure out the activities that are a part of the physical experience. The firms that manage to do this will be able to serve clients across different levels of wealth and be able to build a real-world class business.

The third important point was “One is not looking to retire but succession will happen by design or default. We thought God willing; we should do it by design.”

How many of you think like this?

Remember the best time to fix a roof is when the skies are sunny and not when it’s raining. Likewise, the best time to plan your succession is when things are going great and not when you are forced to.

Most importantly, planning for succession does not mean planning to retire. Like taking life insurance does not mean planning to die.

Let’s get back now to the second question.

Are you afraid to change your mind even in the presence of new (credible) information OR will you be bold enough to incorporate this new information and change your mind?

Which camp are you planning to be in?

Similar Post

Technology

TechFin and FinTech

What do you think is the difference between these 2 words “TechFin and FinTech” or are they one and the same? Well, they are not. TechFin’s are essentially Big Technology c ....Read More

4 April, 2022 | 5 Minute Read

Technology

The Missile Test: Choosing Platforms That Fire Up, Not Fizzle Out

Imagine you are asked to evaluate three missiles and choose the best. One is powerful and world-class, the second is mediocre, and the third is garbage. However, the salespeople fr ....Read More

19 March, 2024 | 7 Minute Read

Technology

Will your clients want the nearest or the best?

There is no such thing as a local advisor anymore. This is the headline of Josh Brown’s column on thereformedbroker blog. I have shared the original post for your ready reference ....Read More

2 March, 2021 | Minute Read

Technology

Investment in Technology versus Digital Transformation

Do the 2 parts in the above headline seem similar to you? I often see many getting confused between an Investment in Technology and Digital Transformation. An investment in Techn ....Read More

24 August, 2021 | 7 Minute Read

Technology

ChatGPT, Humans, and Money

ChatGPT clears the United States Medical Licensing Examination, read a headline. ChatGPT cleared the United States Law School Exam, read another headline in a financial daily. Not ....Read More

21 February, 2023 | 7 Minute Read

Technology

The Missile Test: Choosing Platforms That Fire Up, Not Fizzle Out

Imagine you are asked to evaluate three missiles and choose the best. One is powerful and world-class, the second is mediocre, and the third is garbage. However, the salespeople fr ....Read More

19 March, 2024 | 7 Minute Read

- 1

- 2

0 Comments