This is 1 Clear Choice you must make for your Successful Future

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

August 4, 2020 | 6 Minute Read

My session last Saturday at NetworkFP’s Conference was on the “New Trends and The Future of Financial Planning.” While I spoke about the different trends, my first key point was on the evolution of Wealth Management as an industry.

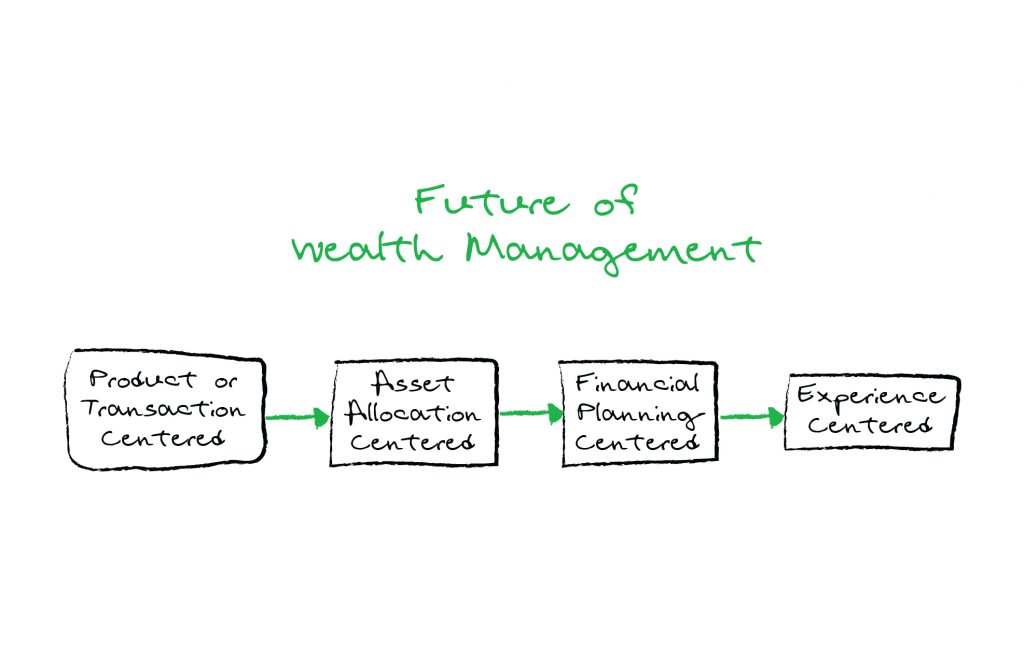

Look at this Sketch carefully.

While many speakers at the conference spoke about the importance of goals, integration of life and money, I could see there were many conflicting messages being sent to the audience (at least I was getting it). Disclaimer: I do not mean any disrespect to any speaker (all of them have accomplished things in their own way, through hard work and merit), or the event (very well organized one). From an audience’s perspective, while there were excellent points or learnings from every speaker, the moot point is “What do I really do if I have to be successful in this profession?” My answer to this is simple: First, Make a choice.

Make a choice about what, you may ask. I promise I will come to that.

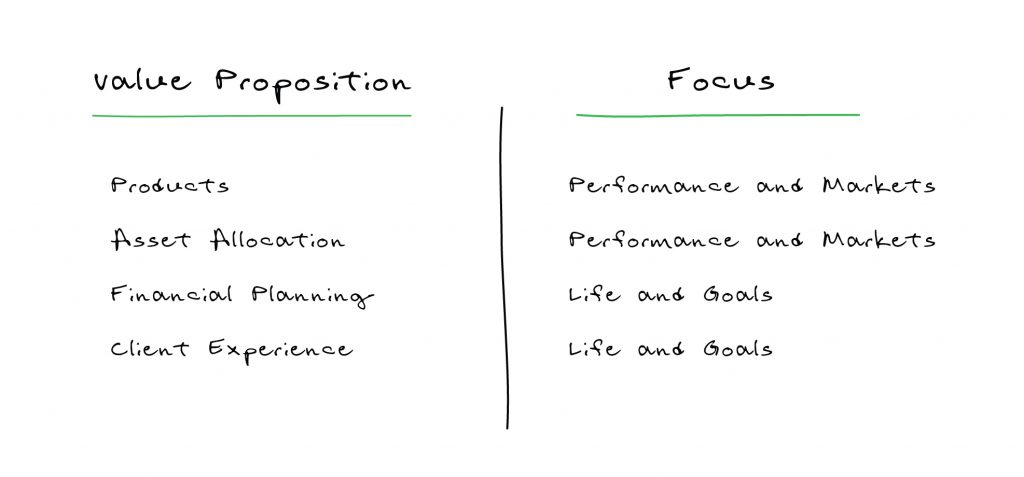

Going back to the above sketch, globally the profession evolved from a Product/Transaction Centric one to an Asset Allocation Centric one to a Financial Planning Centric one to a Client Experience Centric One (or Life Centric One). Majority of the people in India (and across the world) are still focusing on the Product/Transaction centric proposition, some of the larger wealth outfits have moved to an Asset Allocation one, very few have moved to a Financial Planning proposition and even fewer globally too, to a Client Experience proposition . The Product and Asset Allocation proposition can be done by a computer faster, cheaper, and better than you. The real value lies at the Financial Planning and Client Experience Proposition (as this cannot be easily replicated). I will write later, on how to deliver this (in fact I am writing a book on this one). I was blessed to start my career directly in the Financial Planning world bypassing the product and asset allocation value proposition stages.

Let me explain. It is not that I do not use asset allocation as a strategy or products as a tool to achieve client goals. Obviously, I do, but that is not my value proposition.

The tools that I use are not the value that I bring to the client. For example, Virat Kohli can decide whichever bat he uses to play – Do you care? No, because you want him to captain the team, bat well and win the match for us. It does not matter which bat he uses (obviously he will use a good one), but it is not that Choosing a Great Bat A versus Great Bat B will affect his performance dramatically. Another example is that of a surgeon. Have you ever asked a surgeon which company tools he uses? You go to him for an outcome and for a solution to your problem. You believe and rely on their skills and not the bat /tools they use.

Think about it. What is the problem that you are solving for your clients? What is the outcome you hope to deliver?

The outcomes can be interpreted based on your value proposition.

So, you have a choice to make amongst these: Either Select a Product/Transaction Proposition or an Asset Allocation or a Financial Planning + Client Experience Proposition.

Do select one and stick to it. If it is a Product /Transaction one, please be clear about it. Choose your role models in the Product /Transaction space and stick to them. JUST DO WHAT THEY DO or LEARN what they do and then DO IT. Do not waste your time on Financial Planning and do 100 things.

However, if your value proposition is on the Financial Planning side, first chuck the Product /Transaction Mindset and choose your role model in the Financial Planning space. Learn what they do and then JUST DO IT. Do not waste too much on anything else but becoming the best in financial planning and the process of financial planning. Mind you, people who treat Financial Plans as a Product are just carrying over the Product Mindset so understand this point.

Financial Plan as a Product is different from Financial Planning as a Process. I am sure you see the difference here.

I will give you yet another example: Product /Transaction and Financial Planning are 2 separate philosophies like Allopathy and Homeopathy. CHOOSE 1 philosophy and IMPLEMENT it. While as a consumer we might choose to experience both Allopathy and Homeopathy, as a Doctor, I only practice one (and try to be the best in it). I believe that Financial Planning as a Process coupled with Client Experience (Financial Life Planning or what we call as HappyRich Philosophy) is the Future of Financial Planning.

Follow Jim Rohn’s superb quote “It’s doesn’t matter which side of the fence you get off on sometimes. What matters most is getting off. You cannot make progress without making decisions.” Make a decision about the side you want to be on 5 years and 10 years down the line. Where do you want to be in 2025 and 2030?

Another brilliant quote by Keri Russell “Sometimes it’s the smallest decisions that can change your life forever.” This is one of the small (big one actually) decisions (which side do you want to be on) that can transform not only your business but your life and the lives of people you come in contact with. The Power of our Profession is to Transform Lives and remember you have been given that choice.

Similar Post

Growth

This Life Side of Money Conversation helped an IFA 4X his assets in 1.5 hours

I love financial life planning as a profession for the power it has, to transform lives. Recently, a 59-year-old IFA from Nashik, Ganesh Dharker, experienced the power of this Life ....Read More

18 August, 2020 | 7 Minute Read

Growth

“Good is not Good enough” is what this Distributor learnt the Hard Way.

21 April, 2020 | 4 Minute Read

Growth

The A-Ha Moments

A recent HBR article “Sensemaking for Sales” had some wonderful insights. I reproduce some lines here. Read them carefully. In a Gartner survey of 1100 B2B customers, nearly ....Read More

18 January, 2022 | 6 Minute Read

Growth

The Abs that never showed up

Viraj Shetty has always been fascinated by bodybuilding. In fact, he loved it so much that he read almost every book on it. He saw every possible technique and video on it. Yet, no ....Read More

4 May, 2021 | 7 Minute Read

Growth

Part 2 Unveiled: Mastering Sales Productivity Ratios for Growth

Picking up from where we left off in our deep dive into the metrics that define success in our industry, today we're continuing with Part 2 of 'Unlocking the Metrics of Success'. W ....Read More

6 February, 2024 | 7 Minute Read

Growth

On Business Models

After reading the post, “The Oldest Barber Shop in the World?”, one of the readers wrote to me, “Excellent post Amar. I thoroughly enjoyed it, and I started thinking about bu ....Read More

26 March, 2024 | 5 Minute Read

- 0

- 1

0 Comments